|

|||

|

|

|

||

|---|---|---|

|

||

|

||

|

||

|

||

|

||

|

||

|

|

|

|

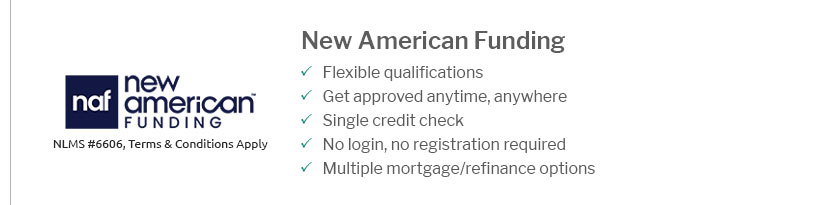

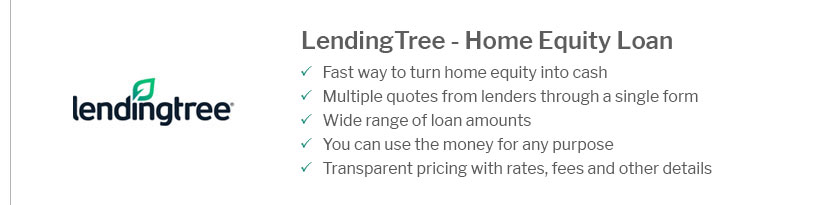

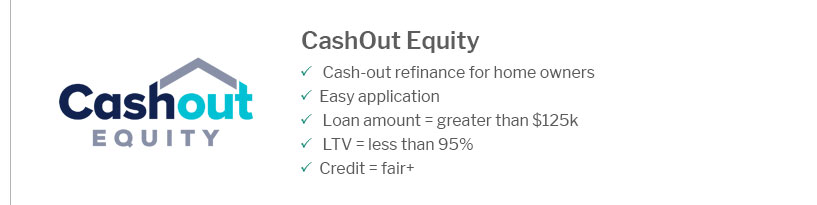

Understanding US Mortgage Lenders: A Comprehensive GuideWhen navigating the intricate landscape of home financing, understanding the role and function of US mortgage lenders is crucial. These financial entities provide the funds necessary for purchasing homes, influencing terms, interest rates, and repayment conditions. The Role of Mortgage LendersMortgage lenders play a pivotal role in the home-buying process. They assess creditworthiness, determine loan eligibility, and establish the financial terms that govern the life of the mortgage. Types of Mortgage Lenders

Choosing the Right LenderSelecting the right mortgage lender can significantly impact your financial future. Consider the following factors:

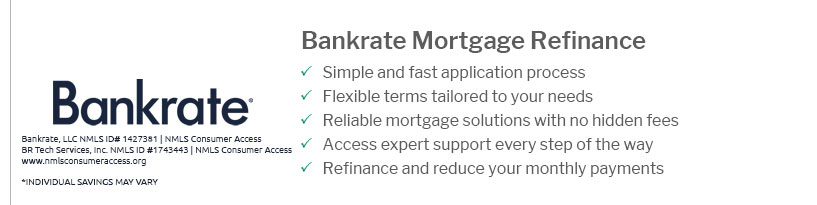

Interest Rates and TermsThe interest rate is a crucial component of any mortgage. It affects the monthly payments and the overall cost of the loan. Fixed and adjustable rates offer different benefits and risks. Refinancing OptionsRefinancing can be a strategic move to reduce interest rates or adjust loan terms. It's important to weigh the benefits and costs before making a decision. Consider using online tools and resources, such as those at should i refinance now, to determine if refinancing aligns with your financial goals. FAQ Section

https://www.usmortgagelenders.com/

US MORTGAGE LENDERS LLC IS A MORTGAGE LOAN ORIGINATOR, NOT A MORTGAGE LENDER. Disclosure: *By refinancing an existing loan, total finance charges may be higher ... https://www.mba.org/

MBA Opens Doors Foundation - Contact Us - About MBA - Leadership - Governance - Speakers Bureau - Work for MBA - Connect with MBA ... https://www.linkedin.com/company/us-mortgage-lenders

954-667-9110 Mortgage Broker providing FHA, VA, Non QM & self-employed, Niche loan programs! - Report this company - Close menu. View all ...

|

|---|